Authors

Since the middle of the year, the spread difference between EUR investment grade and high yield chemicals has widened significantly. This divergence can be explained fundamentally and opens up selective opportunities.

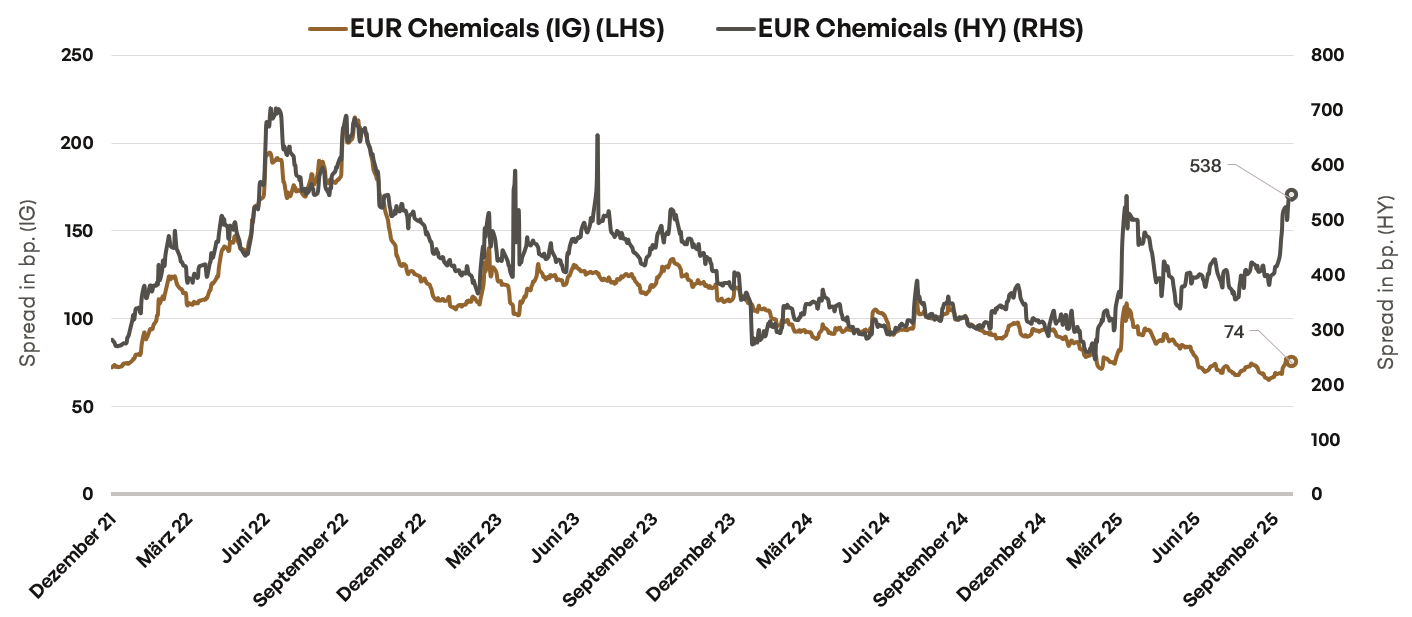

Since the middle of the year, the spread difference between EUR investment grade and high-yield chemicals has widened significantly. While investment grade issuers have been able to keep their spreads largely stable, the risk premiums for bonds issued by high-yield companies have risen significantly.

Divergence in the chemicals sector

Source: Bloomberg, EUR High Yield Chemicals (I05306EU Index), EUR Investment Grade Chemicals (I03133EU Index); period: 31.12.2021 to 22.10.2025.

Chemical companies in the EUR High Yield Index are smaller, regionally concentrated and heavily dependent on Europe. They are struggling with structurally higher energy and CO₂ costs in Europe, persistent price pressure from China and weak European industrial demand, particularly in Germany. Limited pricing power and significantly higher refinancing costs following the rise in interest rates in 2022 are also weighing on free cash flow.

Investment grade issuers, on the other hand, benefit from global diversification and can flexibly relocate their production to regions with better location conditions and thus at least partially avoid the cost pressure. In addition, industrial gas companies, which are less affected by the current cost pressure, are represented exclusively in the investment grade index. Finally, the major issuers have sufficient substance to defend their balance sheet through targeted sales.

The increasing divergence in risk premiums can be justified on fundamental grounds, but the current level is reminiscent of phases in which risk aversion and exaggerated valuations went hand in hand. Unlike in 2022, when the energy crisis and fears of recession dominated, the environment is much more stable today. At present, leading indicators continue to show an expansionary picture and the expected fiscal stimulus in Europe could also create opportunities. Whether cyclical or structural factors ultimately prevail can only be answered by a fundamental analysis of each individual company.

Risks

Price losses due to increases in yields and/or higher risk premiums are possible. A total loss cannot be ruled out either.

Past performance is not an indication of future results, nor can future performance be guaranteed.

Disclaimer

This marketing communication within the meaning of the German Securities Trading Act

(Wertpapierhandelsgesetz) is provided for information purposes only and should not be construed

as personal investment advice or a recommendation or solicitation to buy, sell or hold

any financial instrument or to adopt any investment strategy. The opinions and statements

contained in this document reflect the current assessment on the date of publication. This information does not constitute a complete analysis of all material facts relating to any country,

region or market. This is not to be considered as financial analysis.

If statements are made about market developments, returns, price gains or other asset

growth as well as risk ratios, these merely constitute forecasts for whose occurrence we assume

no liability. Past performance, simulations or forecasts in particular are not a reliable

indicator of future performance. Assets can go up as well as down. All information has been carefully compiled; partly with recourse to information from third parties.Individual details may prove to be no longer or no longer fully accurate, in particular as a result of the passage of time, changes in the law, current developments on the markets, possibly at short notice, and may change at any time without prior notice. Therefore, no guarantee is given that all the information is correct, complete and up to date.

Please inform yourself independently about all costs relevant to you. Maintaining a custody

account may incur costs; ongoing bank charges may also be incurred. Transaction costs depend

on the asset class: For government bonds and collateralised bonds such as mortgage

bonds, they average around 0.02 percent, for corporate bonds 0.085 percent. For less liquid

bonds, the transaction costs can also be significantly higher than 0.25 per cent. It should also

be noted that transaction costs can temporarily be significantly higher during periods of market

stress. For all products sold by HAGIM, all relevant cost information is made available

prior to purchase.

The information is based on our assessment of the current legal and tax situation. If tax or

legal matters are affected, these should be discussed by the addressee with their tax advisor

or lawyer. Investments in financial instruments are associated with both opportunities and

risks. The handling of conflicts of interest at HAGIM is published online in the legal notice on

https://www.ha-gim.com/en/legal-information. The information contained in this document

is intended for professional clients and eligible counterparties only. This information document

is not directed at US citizens or permanent residents, nor to legal entities domiciled in

the USA, nor may it be distributed in the US.