Thomas Rentsch

Senior Portfolio Manager High Yield

Senior secured high-yield bonds suggest security, but without genuine subordinated debt they often bear the full burden of losses in the event of insolvency. In the European high-yield market, the proportion of secured issues has risen sharply in recent years, which has diluted the economic value of seniority. A close examination of the capital structure and collateral quality is therefore crucial in order to distinguish marketing from genuine protection.

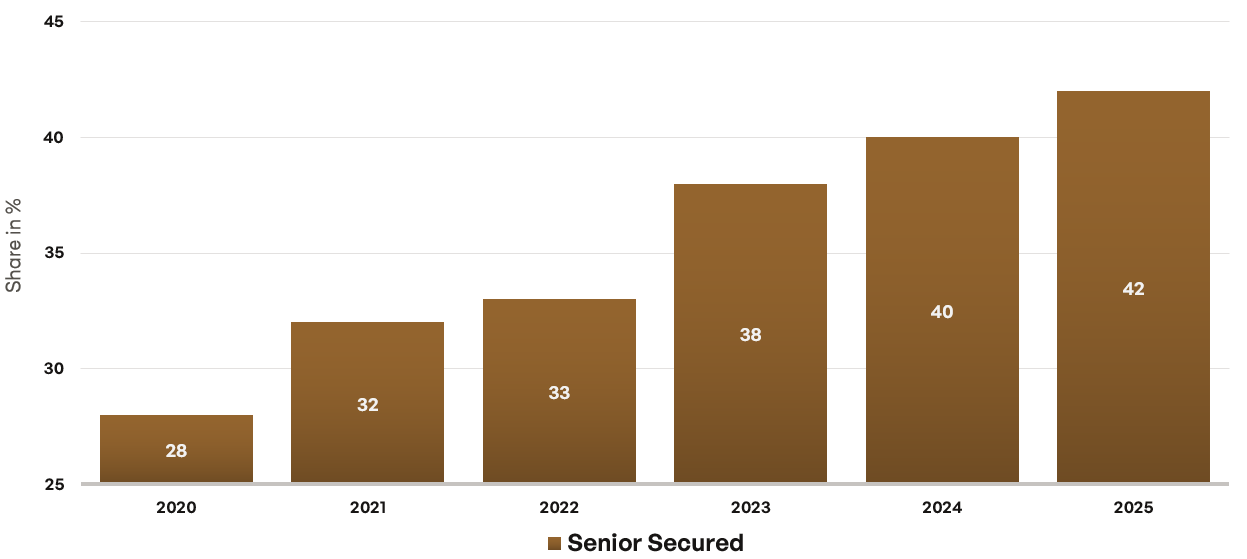

European high-yield bonds have long been synonymous with unsecured, subordinated risks with correspondingly high coupons. In the last years of the 2010s, unsecured bonds dominated the market, but today the picture is completely different (see Chart 1). The majority of new issues are “senior secured”, often accompanied by terms such as “first lien” or “security package”. At first glance, this sounds reassuring – after all, collateralization suggests preferential access to assets in the event of insolvency. But in reality, seniority has been devalued economically.

Change in the European high yield market: rise in senior secured high yield bonds

Source: Bloomberg (Euro HY ex Financials BB-B 3% Capped H23969EU Index); own calculation (Is_Secured); period: 31.12.2016 to 31.12.2025.

Seniority without subordination – a deceptive security

How much protection is actually behind this if there is no longer any real subordinated debt or unsecured bonds in the capital structure? The crux of the matter is that “senior secured” only makes sense relative to something else. If a medium-sized European issuer only has a single tranche of secured high-yield bonds outstanding, then these bonds are formally senior and have collateral. In a crisis, however, it is not the label that is decisive, but the simple question: Are the proceeds from the sale sufficient to repay this one bond in full? If there are no other subordinated creditors to whom losses can be passed on, then the senior secured bond bears the entire economic write-down requirement. It is then only senior on paper.

Typical private equity structures are even more treacherous. Here, the senior secured bond is often topped by a super senior bank facility, such as a revolving loan for working capital. In the event of insolvency, this facility is serviced first, although it hardly takes up any space in the bond’s marketing document. In addition, there are non-financial liabilities such as pension provisions, tax liabilities or high supplier credits, which in practice often compete for the value of the company before or at least alongside the bond creditors. Again, the label “senior secured” is of little value if the collateral package is narrow or legally difficult to enforce.

Case study: 1 billion debt / liquidation value 600 million

Source: Symbolic representation; left scenario = 700m senior secured debt = 85% recovery (=600/700); right scenario = 100m super senior secured debt with 100% recovery, leaving 500m for 900m senior secured debt = 55% recovery (=(600-100)/900)

Organize labels – selection decides

That is why it is not enough to be guided by nice-sounding labels. Anyone investing in European high-yield bonds must take a detailed look at the capital structure, the quality and scope of the collateral, the guarantors, the covenants and the jurisdiction. A “security package” that looks impressive in the prospectus may, on closer inspection, turn out to be a pledge of brand rights and shares in a HoldCo, while the operating assets are left out.

In a market in which almost everything is called “senior secured”, active, bottom-up management is a must. Only those who dissect issuer by issuer, run through stress scenarios and can assess the actual chances of recovery can distinguish between genuine collateralization and a mere marketing label.

“Don’t blindly trust the label ‘senior secured’ – because where there are no subordinated creditors, your supposedly senior bond will bear the full brunt of the crash.”

– Thomas Rentsch

Risks

Price losses due to increases in yields and/or higher risk premiums are possible. A total loss cannot be ruled out.

Past performance is not an indication of future results, nor can future performance be guaranteed.

Disclaimer

This marketing communication within the meaning of the German Securities Trading Act is provided for information purposes only and should not be construed as personal investment advice or a recommendation or solicitation to buy, sell or hold any financial instrument or to adopt any investment strategy. The opinions and statements contained in this document reflect the current assessment at the date of publication. The information contained herein does not constitute a complete analysis of all material facts relating to any country, region or market. No financial analyses are prepared. Where statements are made about market developments, returns, price gains or other asset growth and risk figures, these are merely forecasts and we accept no liability for their occurrence. In particular, past performance, simulations or forecasts are not a reliable indicator of future performance. Assets can fall as well as rise. All information has been carefully compiled, in some cases with recourse to third-party information. Individual details may prove to be no longer or no longer fully accurate, in particular due to the passage of time, changes in the law or current market developments, and may change at any time without prior notice. No guarantee is therefore given for the correctness, completeness and topicality of all information. Please inform yourself independently about all costs relevant to you. Maintaining a custody account may incur costs; ongoing bank charges may also be incurred. Transaction costs depend on the asset class: For government bonds and collateralized bonds such as Pfandbriefe, they average around 0.02 percent, for corporate bonds 0.085 percent. For less liquid bonds, the transaction costs can also be significantly higher than 0.25 percent. It should also be noted that transaction costs can temporarily be significantly higher during periods of market stress. For all products sold by HAGIM, all relevant cost information is provided prior to purchase. The information is based on our assessment of the current legal and tax situation. Insofar as tax or legal matters are affected, these should be discussed by the addressee with its tax advisor or lawyer. Investments in financial instruments are associated with both opportunities and risks. The handling of conflicts of interest at HAGIM is published on the Internet at https://www.ha-gim.com/rechtlichehinweise. The information contained herein is intended for Professional Clients and Eligible Counterparties only. This information document is not intended for US citizens or persons permanently resident in the USA, nor for legal entities domiciled in the USA, nor may it be distributed in the USA