Steffen Ullmann

Senior Portfolio Manager – Investment Grade

Market leadership is not a sure-fire success – even in supposedly stable sectors such as the advertising industry. What was considered a solid position for years can be eroded by operational weaknesses and strategic mistakes. The latest shifts in the sector show this: Competitive position and credit quality are directly linked. For active credit investors, this results in both risks and opportunities.

Market leaders that have been established for years can lose their position faster than many people think. In the global advertising industry – a sector with an annual turnover of around EUR 750 billion – it is currently possible to observe impressively how the balance of power is shifting and how these changes are directly reflected in the credit markets.

After a long phase of clear hierarchies, there were significant shifts in 2025. While the previous market leader is struggling with weak operational development and losing important customer contracts to competitors, rivals are taking the opportunity to expand their positions through targeted takeovers and organic growth.

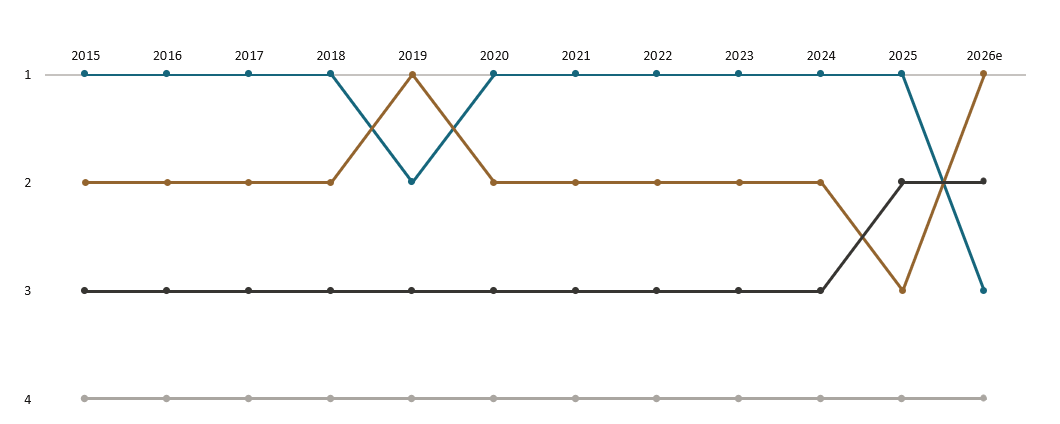

Change in competitive positions

Source: Bloomberg, own calculation: Rank based on sales per year in EUR; period 01.01.2015 to 07.10.2025; own presentation.

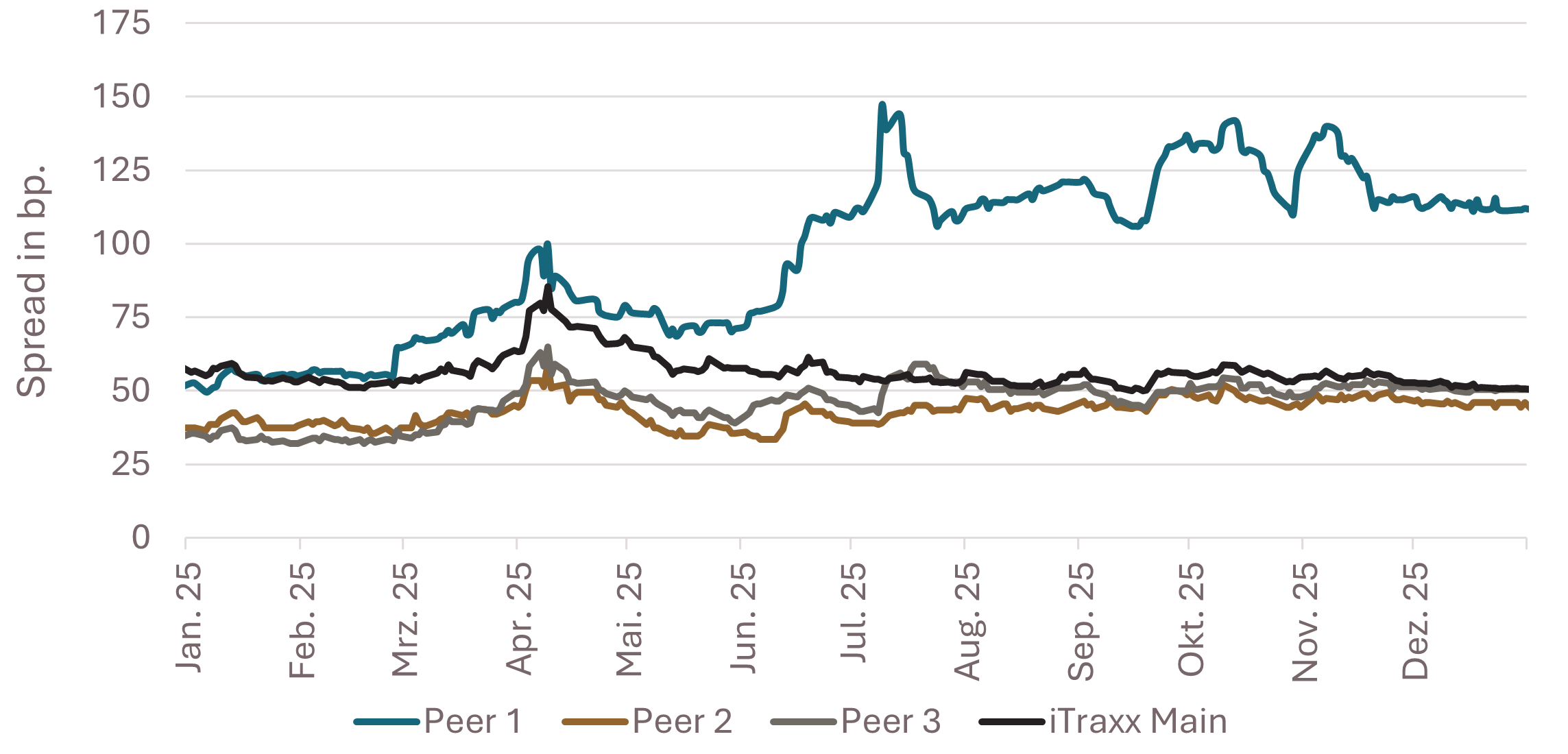

The credit markets have registered this dynamic: The spreads of the market leader, which is under pressure, have widened by around 75 basis points since the beginning of the year, while two rising competitors have recorded spread tightening of 15-25 basis points.

Change in spreads

Source: Bloomberg, 5Y credit default swap spreads, period: 31.12.2024 to 31.12.2025; own presentation.

Such shifts have a direct impact on a company’s credit quality. The competitive position reflects the operational strength and relevance of the business model. The loss of a market leadership position is rarely a sudden event, but the result of a gradual process in which structural weaknesses accumulate over time. These changes are reflected in sales, profitability and cash flow and thus directly influence a company’s ability to meet its interest and repayment obligations.

This dynamic makes it clear why analyzing the competitive position is one of the key elements of a sustainable credit analysis. It is not enough just to look at key figures or ratings. The decisive factor is how a company is positioned within its market, what strategic options it has and how robust its business model actually is in competition.

In the investment grade segment in particular, we focus on the long-term drivers of creditworthiness. Structural characteristics such as business model, market position and competitive dynamics have a lasting impact on credit quality. Changes in these areas are of particular interest to us, as they determine which issuers maintain stability and which lose substance.

“Market leadership is not a static seal of quality, but has to be earned anew every day. In the advertising industry, we are currently observing how delayed strategic adjustments to the digital transformation are having a direct impact on competitive position and credit quality – a lesson in the importance of qualitative analysis in credit investing.”

– Steffen Ullmann

Risks

Price losses due to increases in yields and/or higher risk premiums are possible. A total loss cannot be ruled out either.

Past performance is not an indication of future results, nor can future performance be guaranteed.

Disclaimer

This marketing communication within the meaning of the German Securities Trading Act

(Wertpapierhandelsgesetz) is provided for information purposes only and should not be construed

as personal investment advice or a recommendation or solicitation to buy, sell or hold

any financial instrument or to adopt any investment strategy. The opinions and statements

contained in this document reflect the current assessment on the date of publication. This information does not constitute a complete analysis of all material facts relating to any country,

region or market. This is not to be considered as financial analysis.

If statements are made about market developments, returns, price gains or other asset

growth as well as risk ratios, these merely constitute forecasts for whose occurrence we assume

no liability. Past performance, simulations or forecasts in particular are not a reliable

indicator of future performance. Assets can go up as well as down. All information has been carefully compiled; partly with recourse to information from third parties.Individual details may prove to be no longer or no longer fully accurate, in particular as a result of the passage of time, changes in the law, current developments on the markets, possibly at short notice, and may change at any time without prior notice. Therefore, no guarantee is given that all the information is correct, complete and up to date.

Please inform yourself independently about all costs relevant to you. Maintaining a custody

account may incur costs; ongoing bank charges may also be incurred. Transaction costs depend

on the asset class: For government bonds and collateralised bonds such as mortgage

bonds, they average around 0.02 percent, for corporate bonds 0.085 percent. For less liquid

bonds, the transaction costs can also be significantly higher than 0.25 per cent. It should also

be noted that transaction costs can temporarily be significantly higher during periods of market

stress. For all products sold by HAGIM, all relevant cost information is made available

prior to purchase.

The information is based on our assessment of the current legal and tax situation. If tax or

legal matters are affected, these should be discussed by the addressee with their tax advisor

or lawyer. Investments in financial instruments are associated with both opportunities and

risks. The handling of conflicts of interest at HAGIM is published online in the legal notice on

https://www.ha-gim.com/en/legal-information. The information contained in this document

is intended for professional clients and eligible counterparties only. This information document

is not directed at US citizens or permanent residents, nor to legal entities domiciled in

the USA, nor may it be distributed in the US.