Steffen Ullmann

Senior Portfolio Manager – Investment Grade

Utility bonds have always been regarded as the epitome of defensive investments. However, this sector is increasingly exposed to a field of tension between regulation, politics and demand. At first glance, this development is hardly visible, but there is growing heterogeneity within the sector.

Utility bonds are seen by many as a low-risk investment. Stable demand and regulatory protection have historically allowed for generally high debt levels.

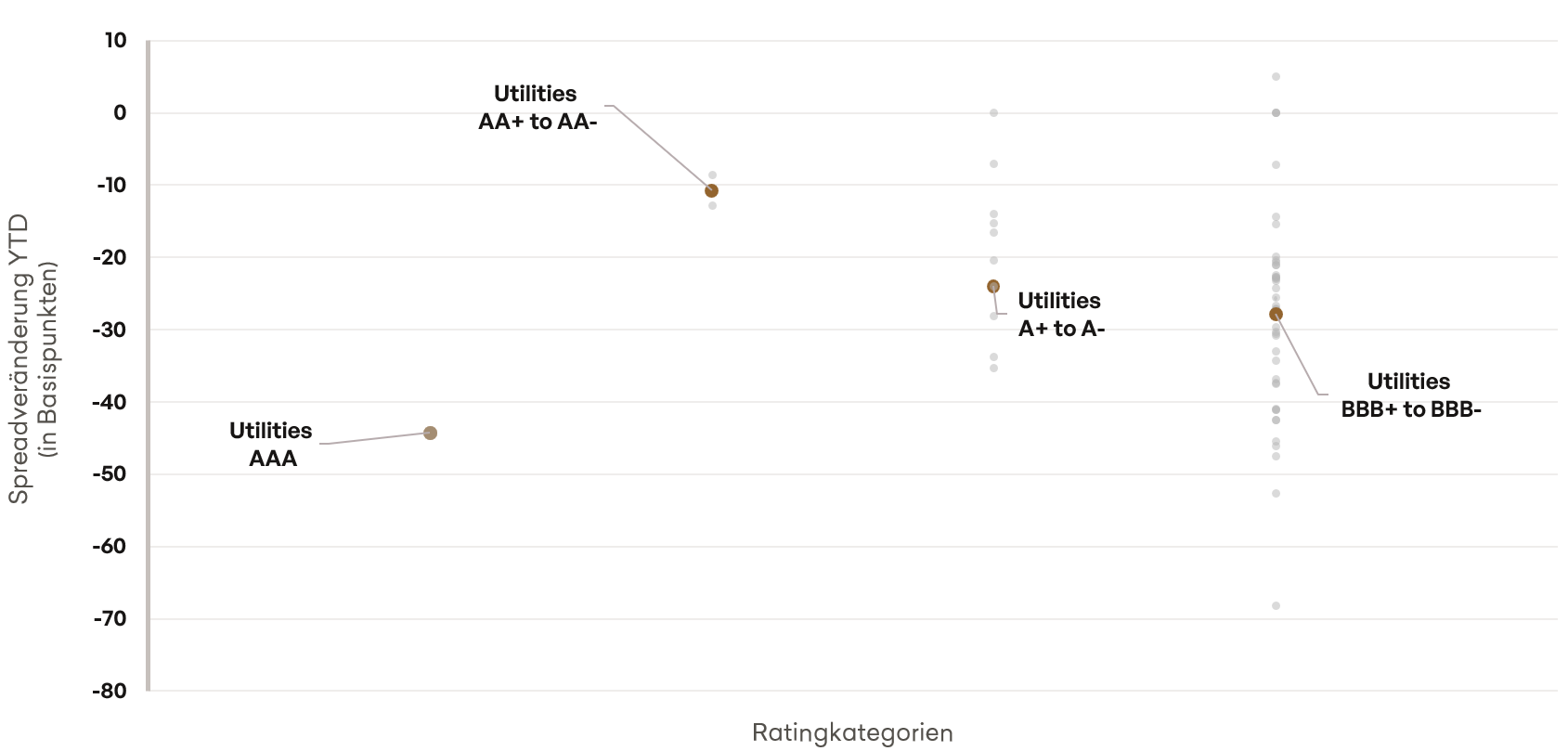

At first glance, the utilities sector remains robust compared to the market as a whole. However, a closer look reveals an increasingly heterogeneous picture within the sector. Figure 1 illustrates the sectoral dispersion of spread development since the start of the year: in the BBB area, the spread is over 70 basis points in some cases.

The background to this development is the growing tension between regulation, politics and demand to which the sector is increasingly exposed:

Regulation: Regulatory framework conditions make it difficult for companies to simultaneously reflect the higher interest rate environment and the growing investments required to achieve net zero targets.

Demand: The growing demand for energy due to electrification and the rapid development of AI applications is significantly increasing the pressure to invest.

Politics: Conflicting political objectives between security of supply, climate targets and price stability increase the influence of government decisions on the sector.

These structural tensions are reflected in the different spread developments. There are fundamental developments behind these figures. Some companies were nationalized, others proactively carried out capital increases in order to finance future investments with equity. Others had to strengthen their balance sheets due to Trump’s anti-renewable policy. In one extreme case, a British water supply company even defaulted.

Figure 1: Dispersion in utilities

Source: Bloomberg, EUR Non-Financial Corporate Index (LECFTREU Index); Bloomberg BClass Level 2 Utilities, only Senior Secured; classification according to BBG Composite Rating; period: 01.01.2025 to 07.10.2025; own presentation.

In view of the tensions described above, we expect spread dispersion to continue to increase in the future. Stock selection will therefore play a more important role, as an idiosyncratic development can ruin an allocation decision, no matter how well thought out. Stability can no longer be taken for granted. This also applies to the historically “defensive” sectors.

“A fundamental analysis is essential, even for supposedly defensive companies. The developments in the utilities sector illustrate this.”

– Steffen Ullmann

Risks

Price losses due to increases in yields and/or higher risk premiums are possible. A total loss cannot be ruled out either.

Past performance is not an indication of future results, nor can future performance be guaranteed.

Disclaimer

This marketing communication within the meaning of the German Securities Trading Act

(Wertpapierhandelsgesetz) is provided for information purposes only and should not be construed

as personal investment advice or a recommendation or solicitation to buy, sell or hold

any financial instrument or to adopt any investment strategy. The opinions and statements

contained in this document reflect the current assessment on the date of publication. This information does not constitute a complete analysis of all material facts relating to any country,

region or market. This is not to be considered as financial analysis.

If statements are made about market developments, returns, price gains or other asset

growth as well as risk ratios, these merely constitute forecasts for whose occurrence we assume

no liability. Past performance, simulations or forecasts in particular are not a reliable

indicator of future performance. Assets can go up as well as down. All information has been carefully compiled; partly with recourse to information from third parties.Individual details may prove to be no longer or no longer fully accurate, in particular as a result of the passage of time, changes in the law, current developments on the markets, possibly at short notice, and may change at any time without prior notice. Therefore, no guarantee is given that all the information is correct, complete and up to date.

Please inform yourself independently about all costs relevant to you. Maintaining a custody

account may incur costs; ongoing bank charges may also be incurred. Transaction costs depend

on the asset class: For government bonds and collateralised bonds such as mortgage

bonds, they average around 0.02 percent, for corporate bonds 0.085 percent. For less liquid

bonds, the transaction costs can also be significantly higher than 0.25 per cent. It should also

be noted that transaction costs can temporarily be significantly higher during periods of market

stress. For all products sold by HAGIM, all relevant cost information is made available

prior to purchase.

The information is based on our assessment of the current legal and tax situation. If tax or

legal matters are affected, these should be discussed by the addressee with their tax advisor

or lawyer. Investments in financial instruments are associated with both opportunities and

risks. The handling of conflicts of interest at HAGIM is published online in the legal notice on

https://www.ha-gim.com/en/legal-information. The information contained in this document

is intended for professional clients and eligible counterparties only. This information document

is not directed at US citizens or permanent residents, nor to legal entities domiciled in

the USA, nor may it be distributed in the US.