Steffen Ullmann

Senior Portfolio Manager – Investment Grade

The current weakness in oil is leading to higher risk premiums – but beneath the surface, the sector is changing fundamentally. The ongoing consolidation in the oil service segment is structurally strengthening business models, improving cash flow quality and creating new investment opportunities. Why selective credit investors should now take a particularly close look.

Trend reversal in the energy service sector: consolidation follows recovery

The energy service sector was under pressure for a long time. However, we have seen a turnaround over the past three years: The industry generated over 50 billion US dollars in net revenue, while at the same time debt fell to its lowest level since 2016 (Source: Deloitte 2025 Oil and Gas Industry Outlook, December 2024.) This recovery initially took place without any major consolidation movements. However, this is changing with the return to profitability and more stable business development. Over the past twelve months, market consolidation has picked up significantly. Several transactions such as the merger of Saipem and Subsea7 or the takeover of ChampionX by Schlumberger underline this.

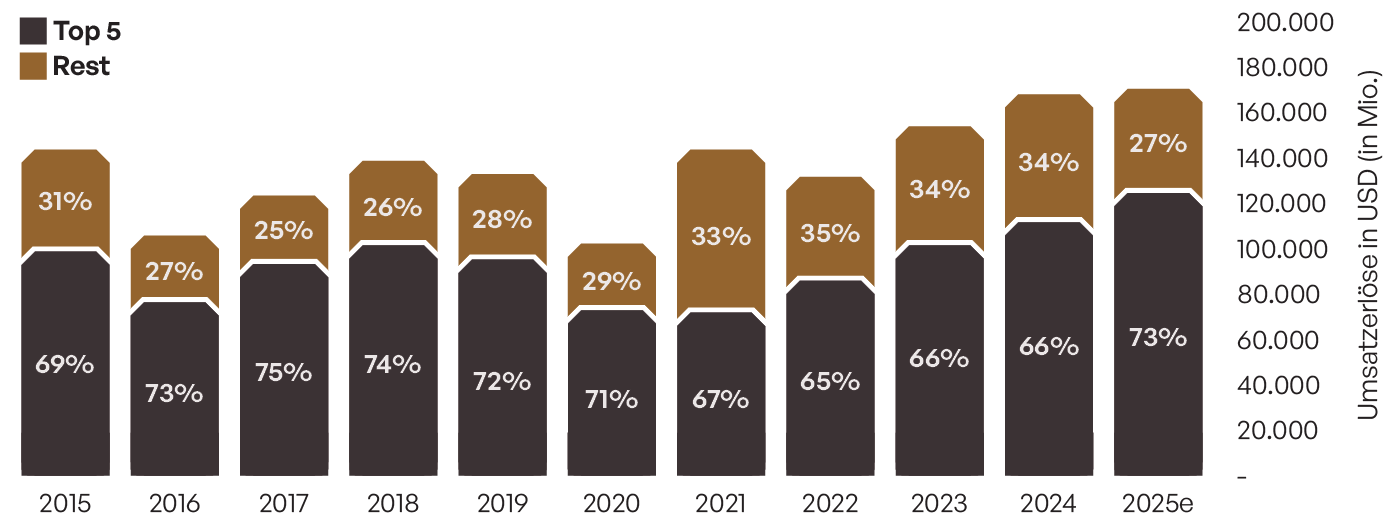

These transactions indicate a renewed wave of market consolidation, which should lead to the five largest providers increasing their combined market share from 66% in 2024 to around 73% in 2025. This will bring the market distribution back closer to the levels seen in 2017/18.

Sales & market share development

Source: Bloomberg, own calculation; Methodology: Sector: Oilfield Services & Equipment, companies with a market capitalization of USD >1 billion, Regions: North America & Europe, Filter: At least 50% share of sales from Oil Field Services according to BICS classification; as of 20.03.2025.

Between price pressure and structural change: consolidation opens up credit opportunities

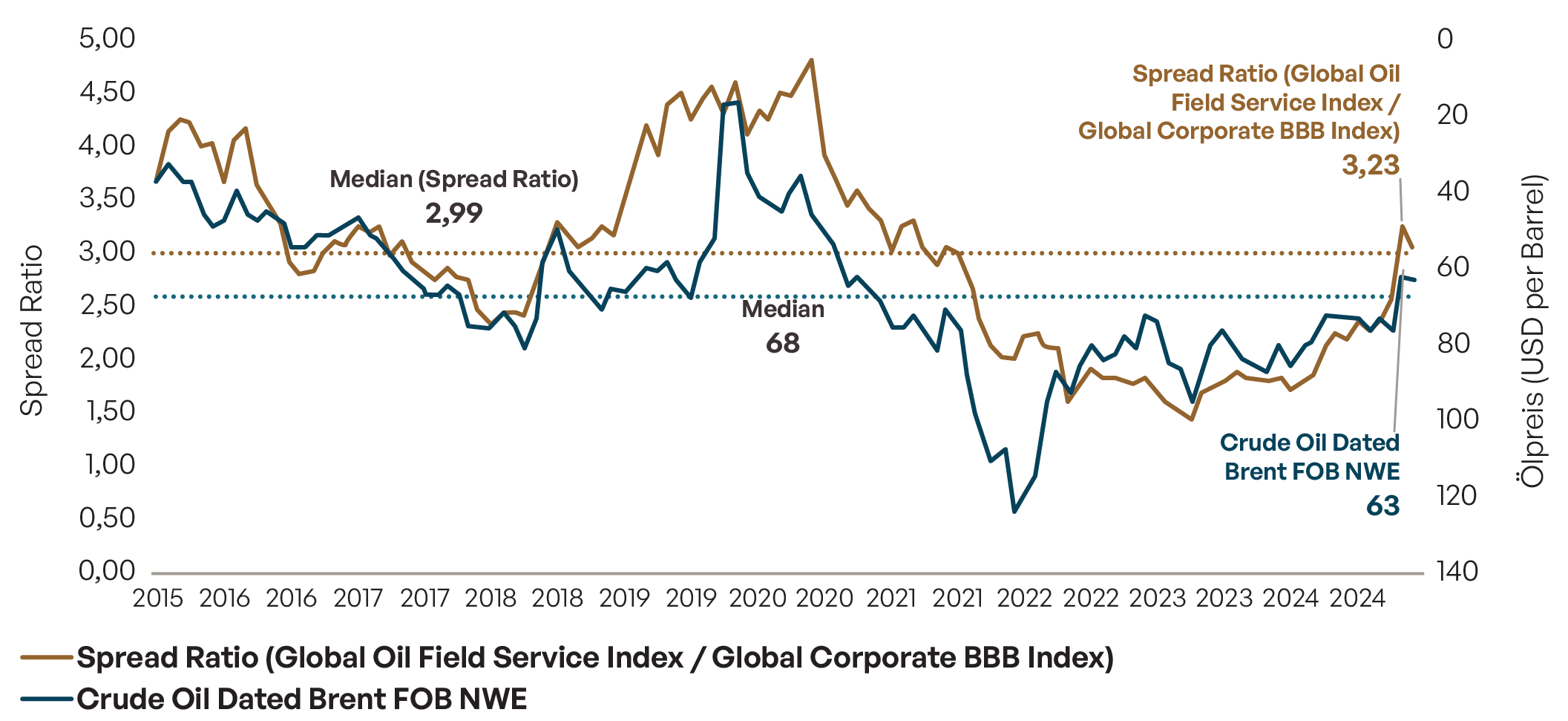

The latest developments on the oil market – in particular the fall in oil prices – have led to a significant widening of risk premiums in oil price-dependent sectors (see Chart 2). This spread movement appears exaggerated from a fundamental perspective. It reflects not so much an actual deterioration in credit quality as sectoral risk aversion.

Historical development

Source: Bloomberg, Bloomberg Global Oil Field Service (I04105 Index) and Bloomberg Global Corporate Baa (I09619 Index) Own calculation: Ratio = OAS Spread (sector) / OAS Spread (benchmark), oil price (EUCRBRDT Index)Period: 31.12.2015 to 30.04.2025.

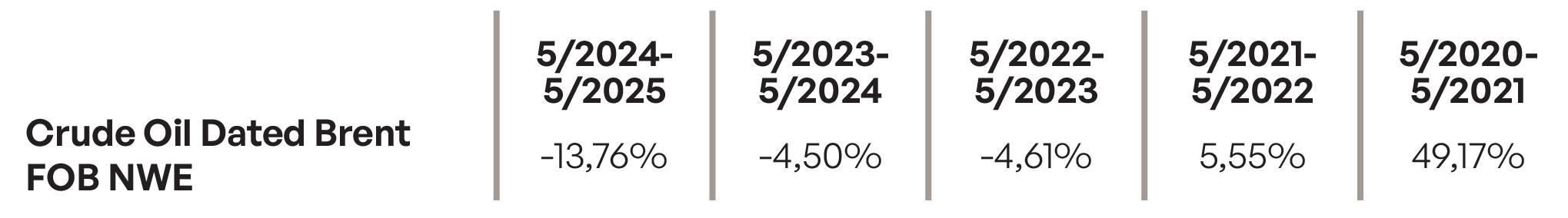

Source: Bloomberg, Crude Oil Dated Brent FOB NEW (EUCRBRDT Index).

It is precisely in this environment that opportunities arise for selective credit investors. The ongoing consolidation in the oil service sector is not only changing the market structure, but also structurally strengthening well-positioned providers. Economies of scale, stronger market positions and improved cost structures have a positive effect on cash flow stability and therefore creditworthiness – and thus create a fundamental counterbalance to the current market volatility.

Table 1 shows the specific opportunities and risks arising from this development:

Opportunities and risks of consolidation in the oil service sector

Opportunities |

– Greater financial stability for market leaders: economies of scale and better cost structures increase profitability and reduce the risk of default. – Improved cash flow visibility: Less competition and greater market control of large providers ensure more stable earnings. – More favorable refinancing options: Leading companies with a better credit rating benefit from lower financing costs and a capital structure that can be planned for the long term.

|

Risks |

– Increased debt due to M&A: Despite predominantly credit-friendly transactions, an increase in debt could have a negative impact on balance sheet quality. – Integration risks and delayed synergies: Savings potential and efficiency gains are not realized immediately and could be diminished by high restructuring costs. – Long-term ESG uncertainties: While larger providers are better able to meet regulatory requirements, adapting to the energy transition remains a structural challenge.

|

“The oil service sector has followed its historical pattern in the short term – but the ongoing consolidation marks a structural change with long-term opportunities for selective credit investors.”

– Steffen Ullmann

Senior Portfolio Manager – Investment Grade

Risks

Price losses due to increases in yields and/or higher risk premiums are possible. A total loss cannot be ruled out either.

Past performance is not an indication of future results, nor can future performance be guaranteed.

Disclaimer

This marketing communication within the meaning of the German Securities Trading Act is provided for information purposes only and should not be construed as personal investment advice or a recommendation or solicitation to buy, sell or hold any financial instrument or to adopt any investment strategy.

The opinions and statements contained in this document reflect current views as of the date of publication. The information contained herein does not constitute a complete analysis of all material facts relating to any country, region or market. No financial analyses are prepared.

Insofar as statements are made about market developments, returns, price gains or other asset growth and risk figures, these are merely forecasts and we accept no liability for their occurrence. In particular, past performance, simulations or forecasts are not a reliable indicator of future performance. Assets can fall as well as rise. All information has been carefully compiled, in some cases with recourse to third-party information. Individual details may prove to be no longer or no longer fully accurate, in particular due to the passage of time, changes in the law or current market developments, and may change at any time without prior notice. We therefore accept no liability for the accuracy, completeness and up-to-dateness of all information.

Please inform yourself independently about all costs relevant to you. Maintaining a custody account may incur costs; ongoing bank charges may also be incurred. Transaction costs depend on the asset class: They average around 0.02 percent for government bonds and collateralized bonds such as Pfandbriefe, and 0.085 percent for corporate bonds. For less liquid bonds, the transaction costs can also be significantly higher than 0.25 percent. It should also be noted that transaction costs can temporarily be significantly higher during periods of market stress. For all products sold by HAGIM, all relevant cost information is provided prior to purchase.

The information is based on our assessment of the current legal and tax situation. Insofar as tax or legal matters are affected, these should be discussed by the addressee with their tax advisor or lawyer.

Investments in financial instruments are associated with both opportunities and risks. The handling of conflicts of interest at HAGIM is published on the Internet at https://www.ha-gim.com/rechtliche-hinweise. The information contained herein is intended for professional clients and eligible counterparties only. This information document is not intended for US citizens or persons permanently resident in the USA, nor for legal entities domiciled in the USA, nor may it be distributed in the USA.