Steffen Ullmann

Senior Portfolio Manager – Investment Grade

Gold price at record levels – but what does this mean for credit quality? While the operating figures of many gold miners are improving in the short term, structural limitations remain.

Strong operating environment, but structural hurdles

Gold producers are currently benefiting from historically high gold prices of over USD 3,000 per ounce. But is this also reflected in improved credit quality in the long term? For a well-founded assessment, the current earnings potential must be clearly distinguished from structural factors in the credit profile.

The current high gold prices should boost income and thus, ceteris paribus, lead to improved cash flow generation. There is therefore a chance that this improved income situation will be reflected in a sustainable improvement in the balance sheet. However, several factors argue against a sustained improvement in credit quality:

Low debt – Many companies already have solid balance sheets. Surplus cash flow therefore flows to shareholders rather than to the balance sheet.

Company size – economies of scale can only be achieved in the long term through acquisitions or new projects.

Country risk – A large proportion of production takes place in emerging markets, which structurally increases the business risk.

In our view, all three factors provide a natural ceiling for credit profiles in the current context.

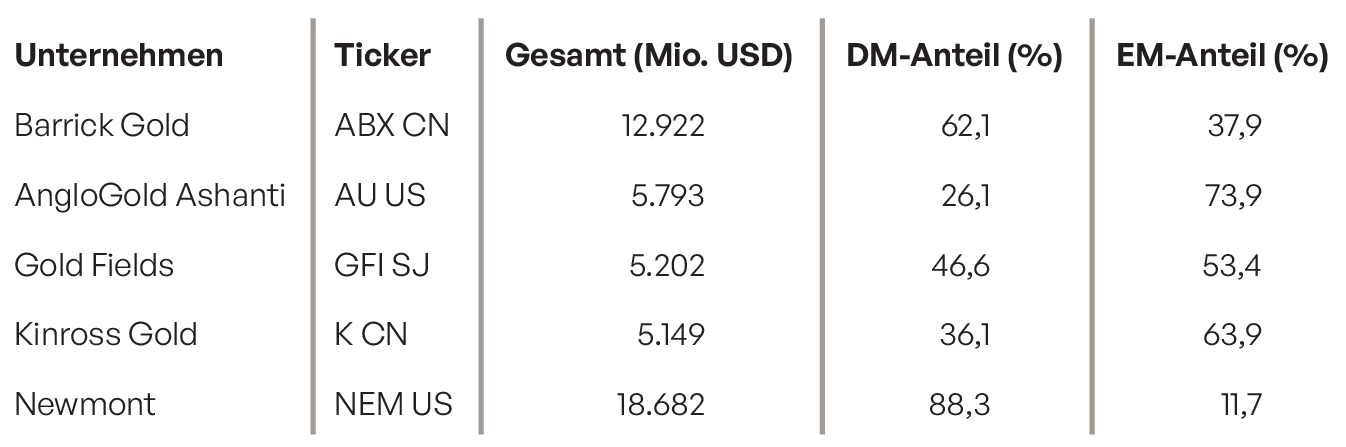

The added value of an independent fundamental analysis is particularly clear when it comes to country risk. As the risk does not come from the sales markets but from the production locations, the distribution of sales is not sufficient as an indicator of country exposure. It should also be noted that companies with a similar mix of developed and emerging market countries are sometimes assigned to different credit universes. From our perspective, this represents an inconsistency.

Source: Bloomberg, sales distribution by developed and emerging markets, own calculation; as at: 26.03.2025.

Complexity needs independent perspectives

It is precisely in these cases that fundamentally oriented, active management excels: It identifies the main drivers of risk – regardless of formal classifications – and assesses the attractiveness in the relevant peer groups. This allows the risk/return ratio to be assessed on a sound basis.

With our credit income opportunities approach, we create clarity in complex market structures and make them investable. We do not rely on labels, but on fundamental analysis – globally conceived, implemented independently of benchmarks.

“Solid fundamental analysis separates

temporary strength of sustainable

Credit quality.”

– Steffen Ullmann

Senior Portfolio Manager – Investment Grade

Risks

Price losses due to increases in yields and/or higher risk premiums are possible. A total loss cannot be ruled out either.

Past performance is not an indication of future results, nor can future performance be guaranteed.

Disclaimer

This marketing communication within the meaning of the German Securities Trading Act (Wertpapierhandelsgesetz) is provided for information purposes only and should not be construed as personal investment advice or a recommendation or solicitation to buy, sell or hold any financial instrument or to adopt any investment strategy. The opinions and statements contained in this document reflect the current assessment on the date of publication. This information does not constitute a complete analysis of all material facts relating to any country, region or market. This is not to be considered as financial analysis.

If statements are made about market developments, returns, price gains or other asset growth as well as risk ratios, these merely constitute forecasts for whose occurrence we assume no liability. Past performance, simulations or forecasts in particular are not a reliable indicator of future performance. Assets can go up as well as down. All information has been

carefully compiled; partly with recourse to information from third parties. Individual details may prove to be no longer or no longer fully accurate, in particular as a result of the passage of time, changes in the law, current developments on the markets, possibly at short notice, and may change at any time without prior notice. Therefore, no guarantee is given that all the information is correct, complete and up to date.

Please inform yourself independently about all costs relevant to you. Maintaining a custody account may incur costs; ongoing bank charges may also be incurred. Transaction costs depend on the asset class: For government bonds and collateralised bonds such as mortgage bonds, they average around 0.02 percent, for corporate bonds 0.085 percent. For less liquid bonds, the transaction costs can also be significantly higher than 0.25 per cent. It should also be noted that transaction costs can temporarily be significantly higher during periods of market stress. For all products sold by HAGIM, all relevant cost information is made available prior to purchase. The information is based on our assessment of the current legal and tax situation. If tax or legal matters are affected, these should be discussed by the addressee with their tax advisor or lawyer. Investments in financial instruments are associated with both opportunities and risks. The handling of conflicts of interest at HAGIM is published online in the legal notice on https://www.ha-gim.com/en/legal-information. The information contained in this document is intended for professional clients and eligible counterparties only. This information document is not directed at US citizens or permanent residents, nor to legal entities domiciled in the USA, nor may it be distributed in the US.