HAGIM CIO Series

It’s all about Selection

The HAGIM CIO Series combines the most attractive investment opportunities from different credit segments into tailored client portfolios. The portfolio construction is centred around fundamental credit analysis and bond selection, so that our experts can identify the best issuers and instruments for a sustainable and solid performance.

The Best of all credit segments

Tailored credit solutions

The strict separation between Investment Grade and High Yield or the geographical segmentation of bonds in developed and emerging markets, is not always ideal for the investment objectives of institutional investors. When constructing portfolios, we focus on the best of all credit segments in order to achieve our clients’ investment objectives.

The three pillars of the HAGIM CIO Series

Quality

We identify attractive credit investments through independent and in-depth credit analysis.

Every decision is evaluated against the clients’ individual risk parameter and return target – not benchmark weightings. Recurring returns and portfolio stability guide our decisions.

Diversification

Different market segments provide distinct risk and return characteristics and by allocating across global credit markets, we achieve robust diversification and attractive risk adjusted returns.

The CIO Series also takes regulatory and accounting requirements into account, carefully combining various credit risk factors to achieve a good balance between return and stability.

Predictability

Our target is to generate regular investment returns that are comfortably higher than the actuarial interest rate of our clients. To achieve this, we rely on high quality credit risk profiles that guarantee stability and predictability, as well as an optimised portfolio structure that minimises transaction costs.

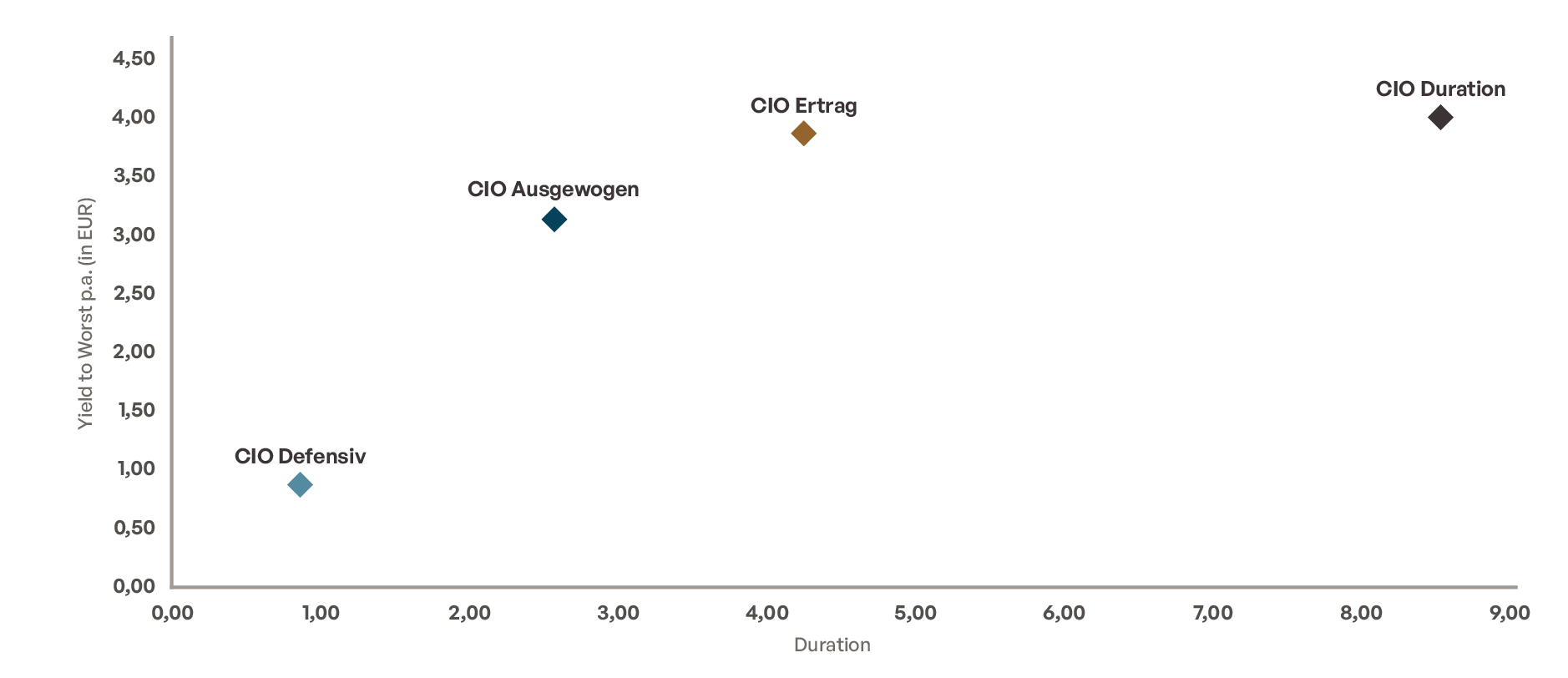

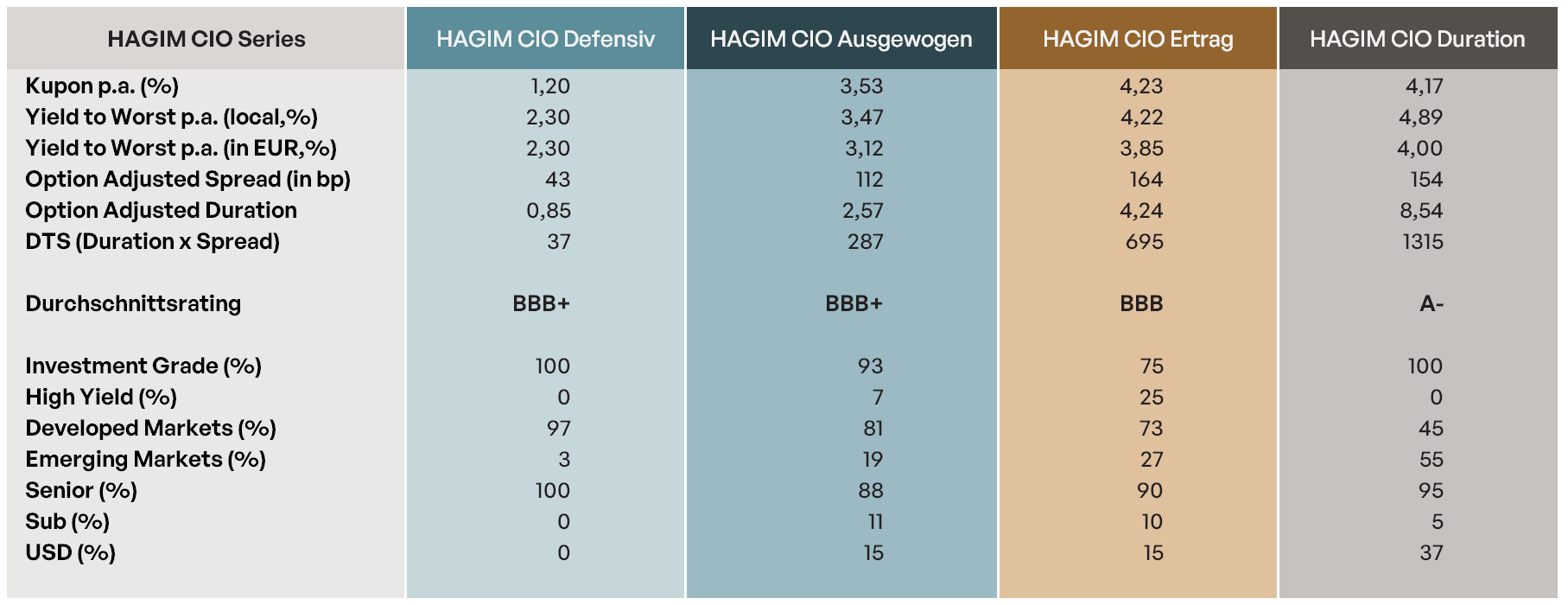

Sample portfolios and key figures

Status: July 2025

Source: own calculation

Portfolio key figures

Disclaimer

This marketing communication within the meaning of the German Securities Trading Act is provided for information purposes only and should not be construed as personal investment advice or a recommendation or solicitation to buy, sell or hold any financial instrument or to adopt any investment strategy. The opinions and statements contained in this document reflect the current assessment at the date of publication. The information contained herein does not constitute a complete analysis of all material facts relating to any country, region or market. No financial analyses are prepared. Where statements are made about market developments, returns, price gains or other asset growth and risk figures, these are merely forecasts and we accept no liability for their occurrence. In particular, past performance, simulations or forecasts are not a reliable indicator of future performance. Assets can fall as well as rise. All information has been carefully compiled, in some cases with recourse to third-party information. Individual details may prove to be no longer or no longer fully accurate, in particular due to the passage of time, changes in the law or current market developments, and may change at any time without prior notice. No guarantee is therefore given for the correctness, completeness and up-to-dateness of all information. Please inform yourself independently about all costs relevant to you. Maintaining a custody account may incur costs; ongoing bank charges may also be incurred. Transaction costs depend on the asset class: For government bonds and collateralized bonds such as Pfandbriefe, they average around 0.02 percent, for corporate bonds 0.085 percent. For less liquid bonds, the transaction costs can also be significantly higher than 0.25 percent. It should also be noted that transaction costs can temporarily be significantly higher during periods of market stress. For all products sold by HAGIM, all relevant cost information is made available prior to purchase. The information is based on our assessment of the current legal and tax situation. Insofar as tax or legal matters are affected, these should be discussed by the addressee with its tax advisor or lawyer. Investments in financial instruments are associated with both opportunities and risks. The handling of conflicts of interest at HAGIM is described at https://www.ha-gim.com/rechtlichehinweise published on the Internet. The information contained herein is intended for Professional Clients and Eligible Counterparties only. This information document is not directed at US citizens or persons permanently resident in the USA, nor at legal entities domiciled in the USA, nor may it be distributed in the USA

HAGIM Newsletter

Would you like to follow the latest financial trends and access exclusive insights as well as valuable expert opinions?

Then subscribe to our HAGIM Newsletter today