Thomas Rentsch

Senior Portfolio Manager High Yield

Die Vorgaben zur CO2-Einsparung aus Sustainability-Linked Bonds (SLBs) umsetzen oder doch lieber eine Strafe zahlen?

Erfahren Sie, warum der Hype um SLBs in einer kühlen Kosten-Nutzen-Rechnung enden und warum es für Konzerne oft günstiger sein könnte, den „grünen Strafzins“ in Kauf zu nehmen? In einem grundlegend veränderten Marktumfeld als noch bei der Emission von SLBs zeigt sich heute ein fundamentaler Konstruktionsfehler.

From green intoxication to cool mathematics

It feels like an eternity ago, but it was only a few years ago that the European high-yield market went into a collective sustainability frenzy. In 2021 and 2022, it seemed almost reckless for issuers not to issue sustainability-linked bonds (SLBs). The promise sounded temptingly elegant: we, the company, will set ourselves ambitious ESG targets – such as reducing CO2 emissions – and if we fail to meet them, we will pay you, the investors, a higher coupon as punishment. It was the perfect financial instrument for a world that believed capitalism and saving the climate could be synchronized by contractual clause. But in the harsh light of late 2025, the euphoria is giving way to cool, almost cynical mathematics.

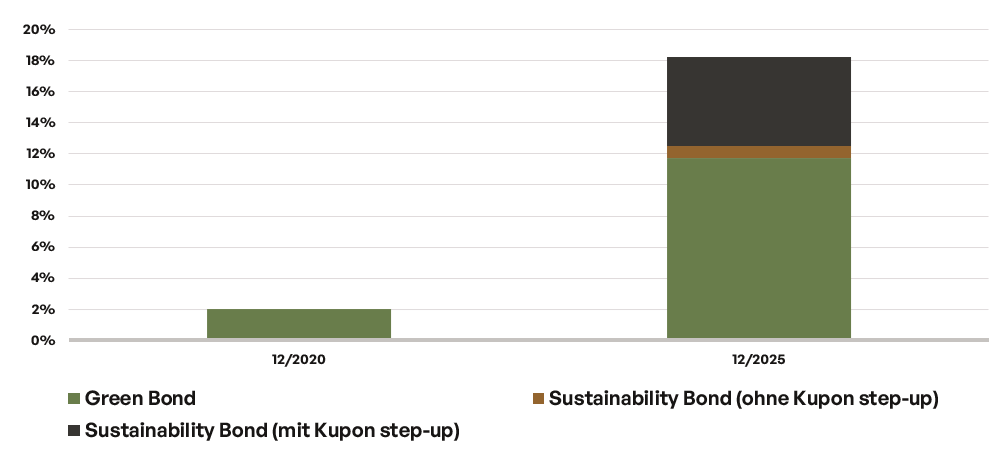

Growth of “ESG” in the European high yield market

Source: Bloomberg Euro High Yield ex Financials BB-B 3% Capped Total Return Index (H23969EU Index); weighting in the index

The design flaw: when the punishment doesn’t hurt

We are now approaching the first major “observation dates”, the key dates on which the accounts are settled. However, the macroeconomic reality has changed drastically since these securities were issued. In an environment characterized by tough inflation, rising refinancing costs and geopolitical uncertainty, CFOs are turning over every euro twice. And this is precisely where the fundamental design flaw of most SLBs is revealed. The threatened penalty for failing to meet climate targets – the so-called step-up – is usually only 25 basis points. For an investment-grade issuer, this may hurt, but in the high-yield universe, where coupons of six, seven or eight percent are the order of the day, this premium is little more than a rounding error.

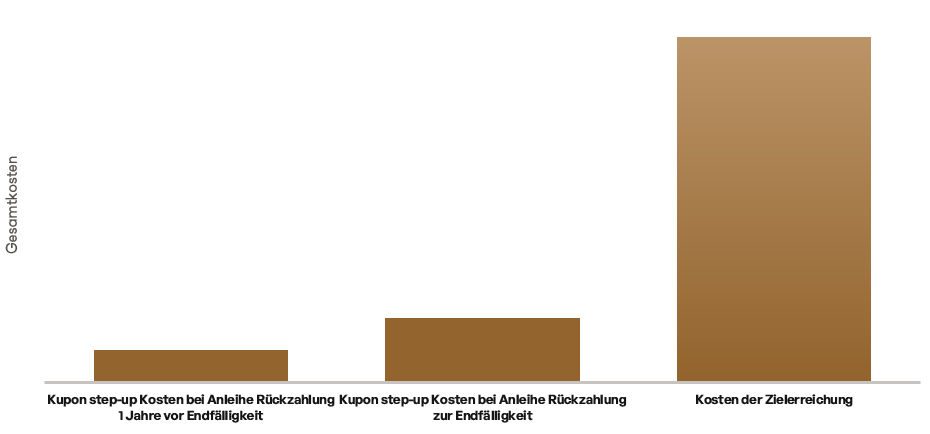

Indulgences instead of investments: the cynical calculation

This leads to a fatal cost-benefit analysis in the boardroom. Many industrial companies are faced with a choice: do we now invest millions in complex new filter systems or the electrification of the vehicle fleet in order to meet the criteria of the bond? Or do we simply accept the step-up? Increasingly, the answer is that the penalty is cheaper than the virtue. The interest surcharge mutates from a deterrent sanction to a simple option premium. For a paltry 0.25 percentage points, the company buys the right to postpone climate protection. The noble incentive structure becomes a modern indulgence trade, where the financial pain is far too small to force a real change in behavior when it becomes economically uncomfortable.

Airline – target reduction of greenhouse gas emissions -10%; o.25% coupon penalty for last 2 years if target not met

Source: Fictitious example

A toothless tiger: the lesson for the market

This is a sobering development for investors. Those who bought these bonds wanted to see impact, not a marginally higher return based on the failure to meet sustainability targets. If it now turns out that issuers are simply pricing in the step-up as the “cost of doing business”, the asset class will lose its credibility. The market is learning the hard way that goodwill in loan agreements only lasts if the economic incentives bite even in a crisis. As long as it is cheaper to pollute the environment and pay a small fee to creditors, the SLB will remain a toothless tiger in a market that desperately needs teeth.

“Often the rational decision of companies is that punishment is cheaper than virtue.”

– Thomas Rentsch

Risks

Price losses due to increases in yields and/or higher risk premiums are possible. A total loss cannot be ruled out.

Past performance is not an indication of future results, nor can future performance be guaranteed.

Disclaimer

This marketing communication within the meaning of the German Securities Trading Act is provided for information purposes only and should not be construed as personal investment advice or a recommendation or solicitation to buy, sell or hold any financial instrument or to adopt any investment strategy. The opinions and statements contained in this document reflect the current assessment at the date of publication. The information contained herein does not constitute a complete analysis of all material facts relating to any country, region or market. No financial analyses are prepared. Where statements are made about market developments, returns, price gains or other asset growth and risk figures, these are merely forecasts and we accept no liability for their occurrence. In particular, past performance, simulations or forecasts are not a reliable indicator of future performance. Assets can fall as well as rise. All information has been carefully compiled, in some cases with recourse to third-party information. Individual details may prove to be no longer or no longer fully accurate, in particular due to the passage of time, changes in the law or current market developments, and may change at any time without prior notice. No guarantee is therefore given for the correctness, completeness and topicality of all information. Please inform yourself independently about all costs relevant to you. Maintaining a custody account may incur costs; ongoing bank charges may also be incurred. Transaction costs depend on the asset class: For government bonds and collateralized bonds such as Pfandbriefe, they average around 0.02 percent, for corporate bonds 0.085 percent. For less liquid bonds, the transaction costs can also be significantly higher than 0.25 percent. It should also be noted that transaction costs can temporarily be significantly higher during periods of market stress. For all products sold by HAGIM, all relevant cost information is provided prior to purchase. The information is based on our assessment of the current legal and tax situation. Insofar as tax or legal matters are affected, these should be discussed by the addressee with its tax advisor or lawyer. Investments in financial instruments are associated with both opportunities and risks. The handling of conflicts of interest at HAGIM is published on the Internet at https://www.ha-gim.com/rechtlichehinweise. The information contained herein is intended for Professional Clients and Eligible Counterparties only. This information document is not intended for US citizens or persons permanently resident in the USA, nor for legal entities domiciled in the USA, nor may it be distributed in the USA