Steffen Ullmann

Senior Portfolio Manager – Investment Grade

How reliable were our analyses and forecasts in last year’s dynamic market environment? In the following review, our Senior Portfolio Manager Steffen Ullmann takes stock of our assessments in the investment grade market in 2024 in an open and well-founded manner.

Recap of the article from 28.10.2024: BBB bonds put to the test

Conclusion from 28.10.2024: Despite the challenging macroeconomic environment and lower risk premiums, BBB bonds continue to offer attractive yield opportunities. However, a stronger focus on individual company developments is required again.

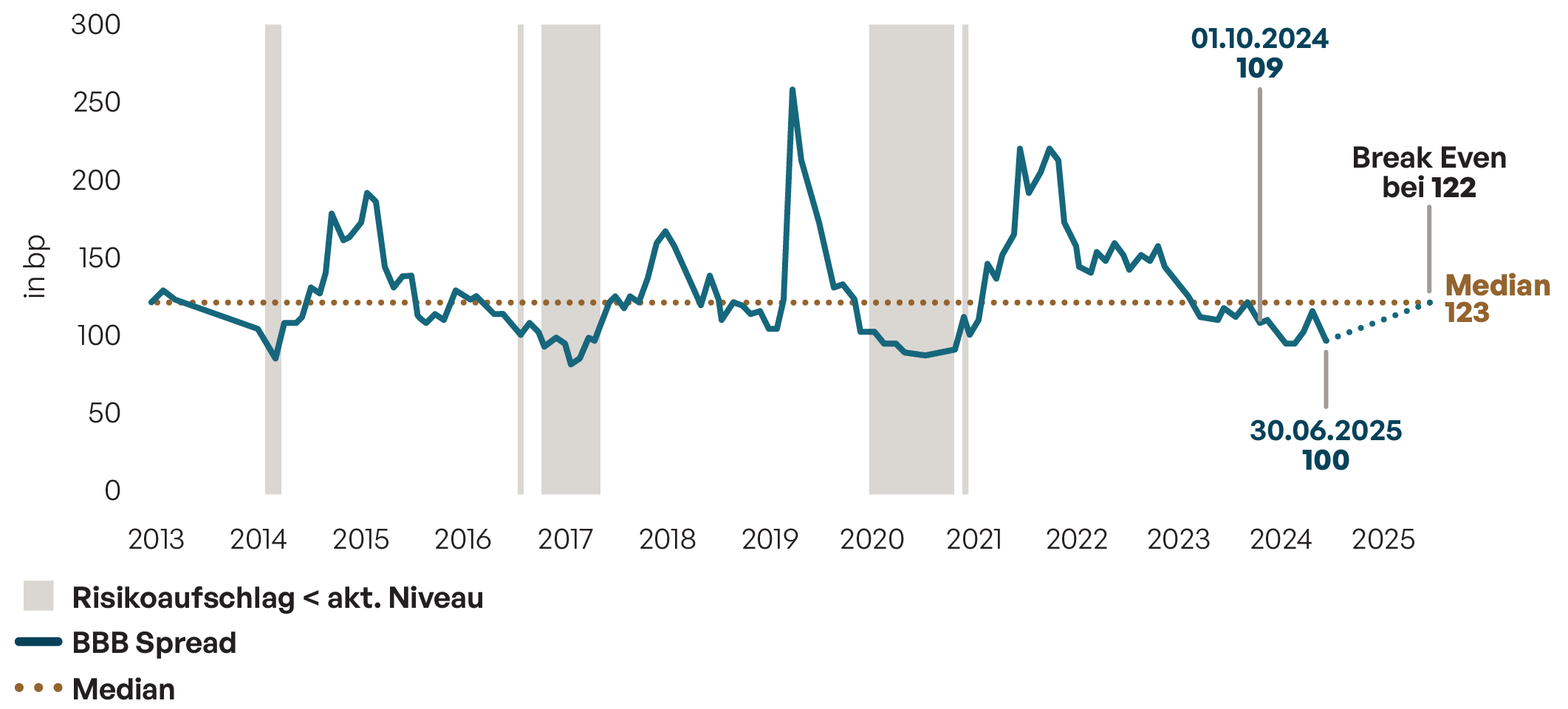

Today: BBB spreads are surprisingly robust despite global uncertainties – from geopolitical tensions to customs conflicts. At currently 103 basis points, they remain well below the historical median and below the level of October 2024. This allows only one conclusion to be drawn: the market continues to trust in the resilience of corporate balance sheets. High margins and low debt ratios ensure stability – even in the riskier part of the investment grade spectrum.

BBB spreads over time

Source: Bloomberg, I10362EU Index (Bloomberg Euro-Aggregate: Industrials Baa), own presentation, as at 30.06.2025.

Recap of the article from 03.05.2024: Positive economic news

Conclusion of 03.05.2024: In view of the current macroeconomic risks and historical observations, we expect risk premiums to remain stable in the best-case scenario. In our view, general market risk should be reduced and the focus should increasingly be on relative value opportunities in the investment grade segment.

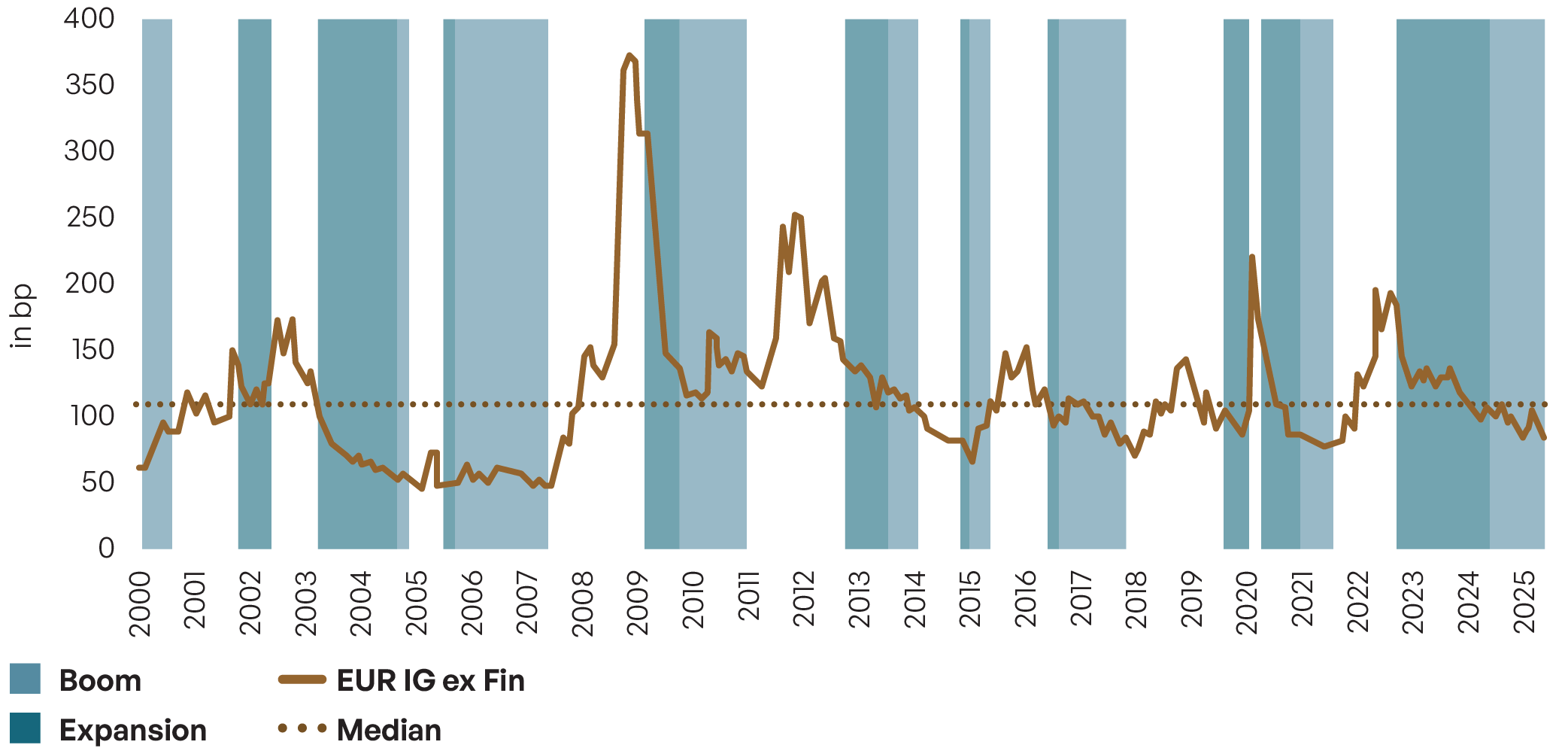

Today: Risk premiums for corporate bonds have fallen further and are currently trading below 80 basis points compared to 99 in May 2024. This means that our assessment of sideways-trending risk premiums has not been confirmed to date.

Against the backdrop of global uncertainties with partly opposing effects on sectors and companies, the broad market hardly offers any scope for further spread tightening. In this environment, it is all the more important to take a more differentiated approach.

Development of EUR IG spreads over the economic cycle

Source: Own illustration; Bloomberg (Bloomberg Euro AGG Corporate Excl Financials Index OAS; 4 Big European OECD Leading Indicators

CLI Amplitude Adjusted SA) ; as at 30.06.2025

Recap of the article from 08.07.2024: Credit risk premiums in the European aviation sector

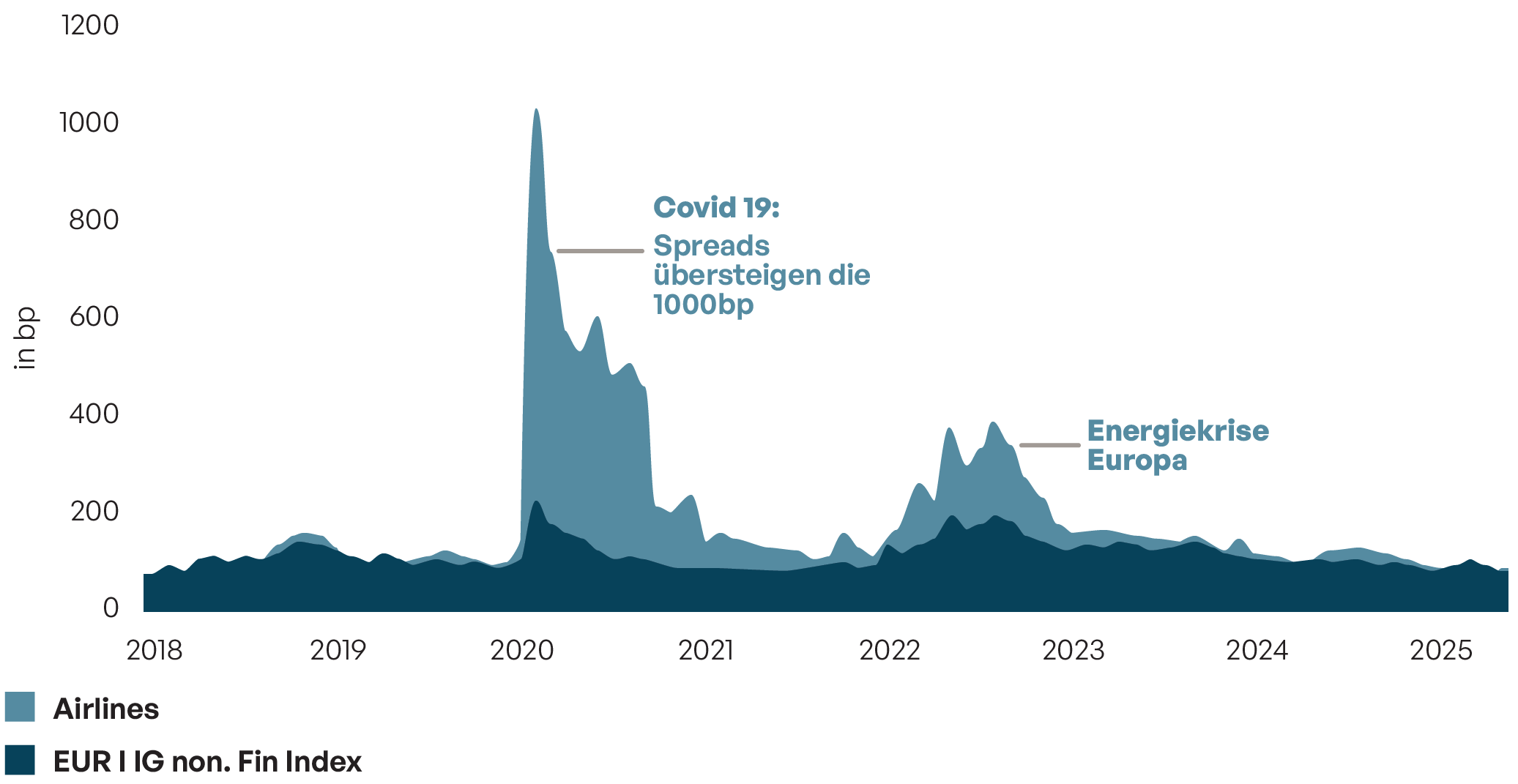

Conclusion from 08.07.2024: Operational recovery, high debt, low equity buffer and strong dependence on external factors: risks that, in our opinion, are hardly reflected in the current credit risk premiums.

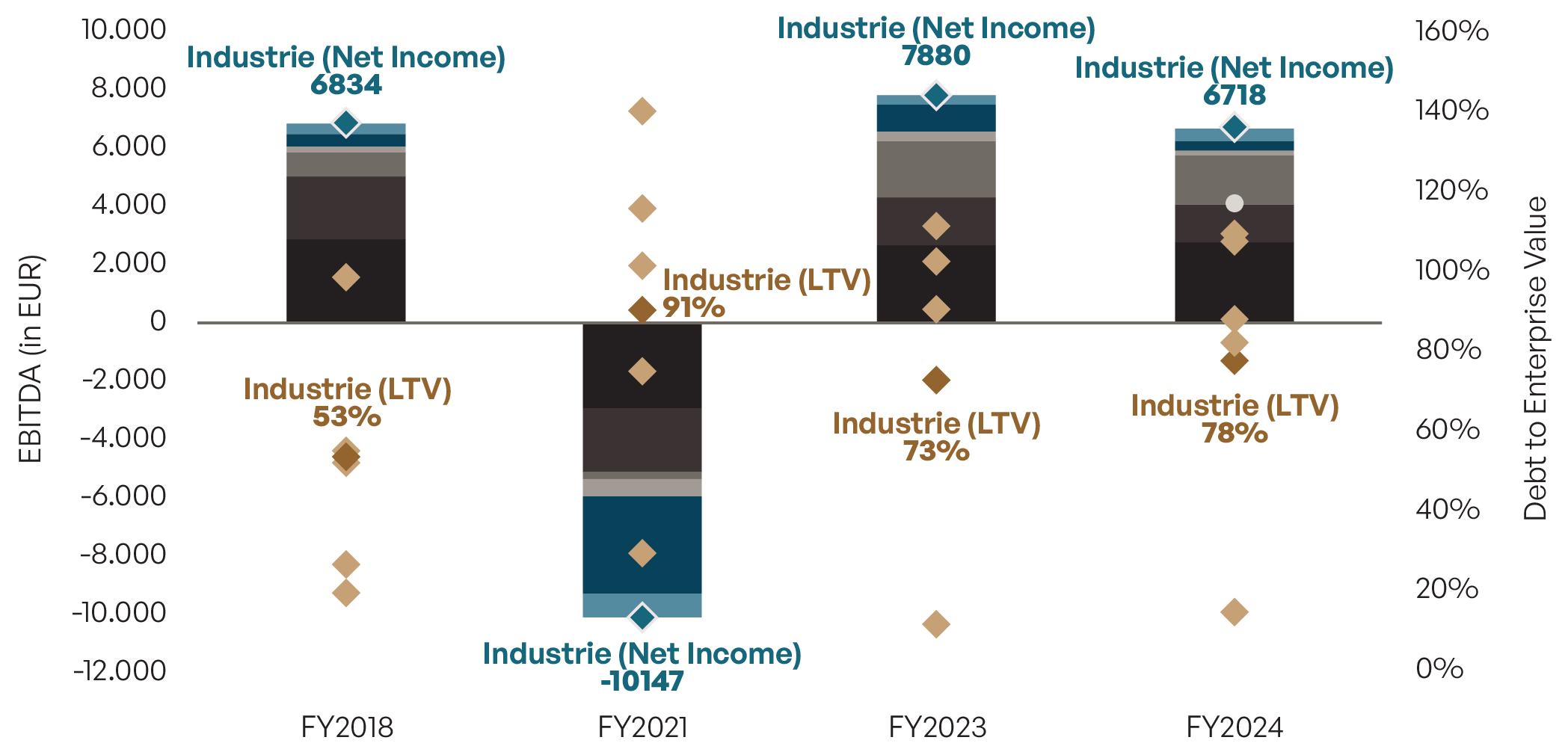

Today: One year after our analysis, Europe’s airlines are proving more robust than expected: despite temporary burdens from exogenous shocks, their risk premiums are now below the index. While the latest annual results continue to paint a robust operating picture, debt levels (LTV) remain high. The operational recovery is boosting confidence – but high debt levels, low equity buffers and strong dependence on external factors remain structural risks.

Hardly any equity buffer left

Source: Bloomberg, own calculation; as at 30.06.2025

Risk premiums over time

Source: Bloomberg, EUR IG non Financial Index (LECFTREU Index); Airlines (I03123EU Index); as at 30.06.2025

Recap of the article from 10.10.2024: Automotive sector – Challenging times

Conclusion from 10.10.2024: Despite the more attractive valuations, we believe that a clear “show me” moment has arrived for the automotive sector. Before a sector overweight can be considered, companies must first prove that they are taking the right measures to address the current challenges. Until then, we remain selective.

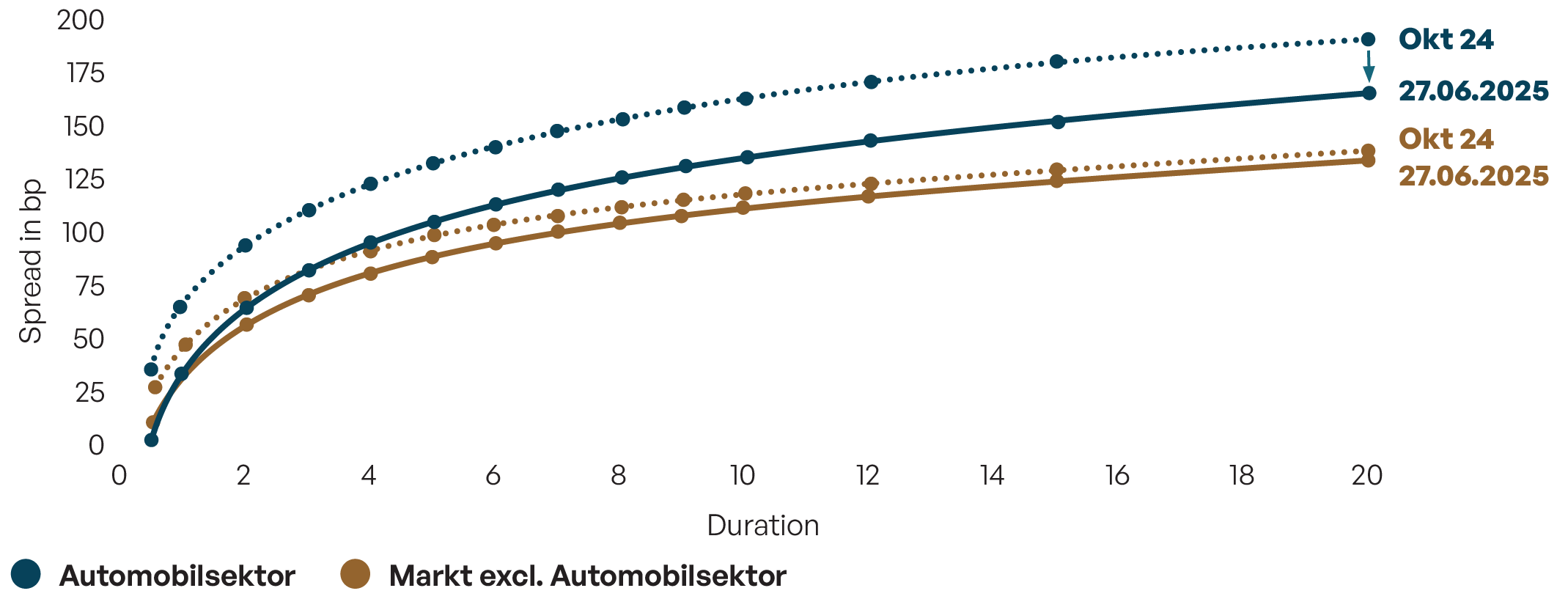

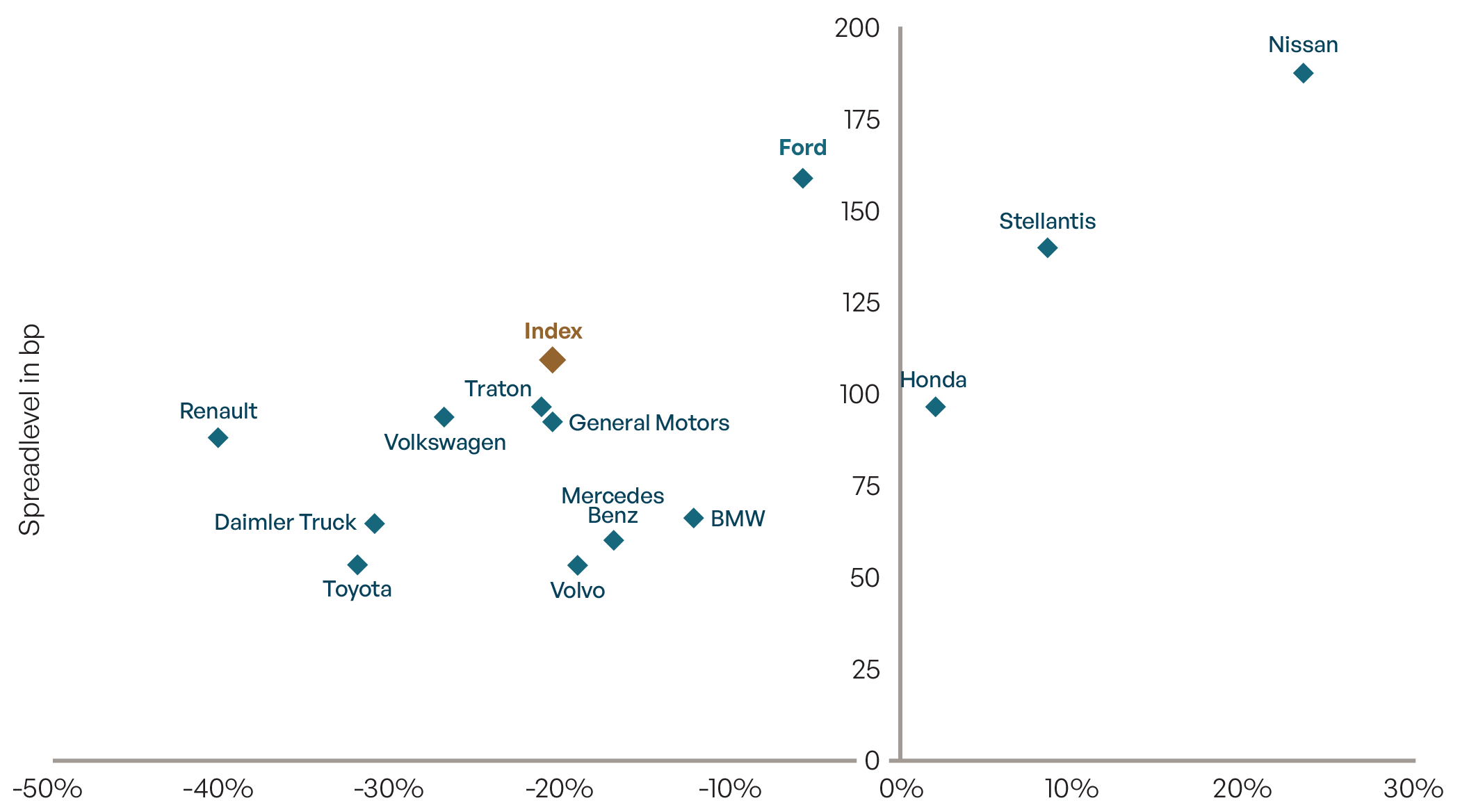

Today: Despite 25% tariffs on US imports, increasing competition from Chinese producers and a general rise in uncertainty, the automotive sector has significantly outperformed the market as a whole since October 2024. However, a closer look reveals that not every issuer is among the winners, as the strong sector performance masks a high degree of dispersion: only a few issuers have clearly outperformed the market, while others have fallen noticeably behind. Some manufacturers impressed with solid balance sheets and a clear strategic direction. Others are still in adjustment mode. Our assessment remains unchanged: Selection remains the key.

Change in credit curves in the last 6 months

Source: Bloomberg EUR AGG Corporate ex Financials Total Return Index (LECFTREU Index), own calculation, as at 27.06.2025

Spread development in the automotive sector since October 2024

Source: Bloomberg, own calculation; period: 30.09.2024 to 27.06.202

Risks

Price losses due to increases in yields and/or higher risk premiums are possible. A total loss cannot be ruled out either.

Past performance is not an indication of future results, nor can future performance be guaranteed.

Disclaimer

This marketing communication within the meaning of the German Securities Trading Act is provided for information purposes only and should not be construed as personal investment advice or a recommendation or solicitation to buy, sell or hold any financial instrument or to adopt any investment strategy.

The opinions and statements contained in this document reflect current views as of the date of publication. The information contained herein does not constitute a complete analysis of all material facts relating to any country, region or market. No financial analyses are prepared.

Insofar as statements are made about market developments, returns, price gains or other asset growth and risk figures, these are merely forecasts and we accept no liability for their occurrence. In particular, past performance, simulations or forecasts are not a reliable indicator of future performance. Assets can fall as well as rise. All information has been carefully compiled, in some cases with recourse to third-party information. Individual details may prove to be no longer or no longer fully accurate, in particular due to the passage of time, changes in the law or current market developments, and may change at any time without prior notice. We therefore accept no liability for the accuracy, completeness and up-to-dateness of all information.

Please inform yourself independently about all costs relevant to you. Maintaining a custody account may incur costs; ongoing bank charges may also be incurred. Transaction costs depend on the asset class: They average around 0.02 percent for government bonds and collateralized bonds such as Pfandbriefe, and 0.085 percent for corporate bonds. For less liquid bonds, the transaction costs can also be significantly higher than 0.25 percent. It should also be noted that transaction costs can temporarily be significantly higher during periods of market stress. For all products sold by HAGIM, all relevant cost information is provided prior to purchase.

The information is based on our assessment of the current legal and tax situation. Insofar as tax or legal matters are affected, these should be discussed by the addressee with their tax advisor or lawyer.

Investments in financial instruments are associated with both opportunities and risks. The handling of conflicts of interest at HAGIM is published on the Internet at https://www.ha-gim.com/rechtliche-hinweise. The information contained herein is intended for professional clients and eligible counterparties only. This information document is not intended for US citizens or persons permanently resident in the USA, nor for legal entities domiciled in the USA, nor may it be distributed in the USA.