The European high-yield-market has long experienced a dominant phase of “Rising Stars”. This trend will reverse in 2025: Higher refinancing costs and geopolitical risks will lead to more downgrades of “Fallen Angels”. Investors must now manage risks more closely.

The European high-yield-market has undergone a remarkable development in recent years. For a long time, the picture was characterized by so-called Rising Stars – i.e. issuers that have risen from the High-Yield segment to Investment Grade. Prominent examples include the airlines Lufthansa and IAG or Accor, the French hotel chain, which made the leap back into the ranks of first-class borrowers in 2023.

By the end of 2024, the trend towards more Rising Stars than Fallen Angels was clearly recognizable. This was not least due to a robust economic phase after the pandemic and extremely low financing costs. Many companies used this phase to align their financing for the long term. This helped them to survive the period of rising interest rates between 2022 and 2023. It was also crucial that former Investment-Grade companies pursued the clear goal of returning to the Investment-Grade segment in order to benefit from more favorable refinancing costs.

Fallen Angels – i.e. companies that were downgraded from Investment Grade to High Yield – were the exception rather than the rule during this phase. This mainly affected sectors with structural problems such as parts of the automotive industry or real estate companies, which suffered from higher interest rates and weak demand.

In 2025, however, the picture has changed noticeably: The number of potential Fallen Angels now exceeds that of Rising Stars. This means that the ratio has reversed for the first time in years. The reasons for this are ongoing geopolitical tensions, the impact of trade conflicts and higher refinancing costs, which are now having a delayed effect. Companies with a weaker margin base or in structurally weakened sectors in particular are coming under pressure as a result. At the same time, the number of up-and-comers has decreased, as the rating agencies are acting more cautiously in the uncertain environment and many companies have been able to stabilize their credit rating, but have not been able to improve it.

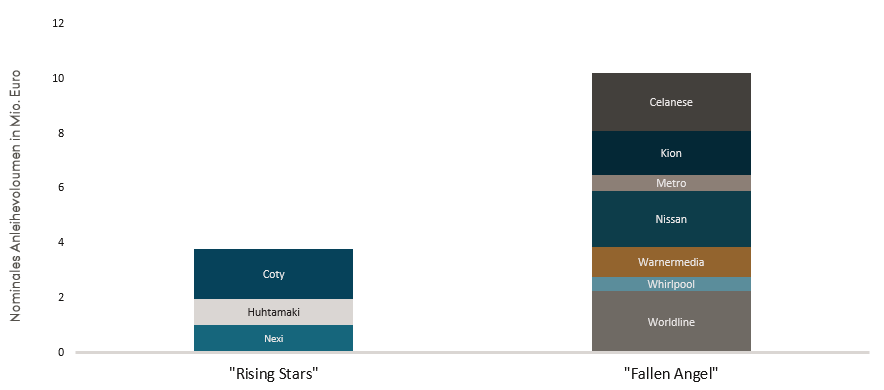

2025 “Rising Stars” vs. “Fallen Angels”

Source: Outstanding nominal volume in the following indices: Bloomberg Euro Aggreggate Corporate ex Financials Index (LECFTREU Index) and Bloomberg Euro High Yield ex Financials BB-B 3% Capped Total Return Index (H23969EU Index)

For investors, this turnaround means a changed starting position. While the search for Rising Stars has been an attractive strategy in recent years in order to benefit from price gains following rating upgrades, risk management is now coming more to the fore. Fallen Angels can offer opportunities, as their spreads often rise disproportionately after a downgrade and can normalize again when they stabilize – but this requires careful individual stock selection. Investors need to differentiate more clearly between issuers that are only temporarily under pressure and those that have structural problems.

Conclusion:

The European high-yield market therefore remains exciting, but priorities have shifted:

The identification of rising stars is becoming more difficult, while new opportunities are opening up for active investors in fallen angels – whether through early avoidance or the targeted picking up of securities after possible excessive spread widening.

Risks

Price losses due to increases in yields and/or higher risk premiums are possible. A total loss cannot be ruled out either.

Past performance is not an indication of future results, nor can future performance be guaranteed.

Disclaimer

This marketing communication within the meaning of the German Securities Trading Act

(Wertpapierhandelsgesetz) is provided for information purposes only and should not be construed

as personal investment advice or a recommendation or solicitation to buy, sell or hold

any financial instrument or to adopt any investment strategy. The opinions and statements

contained in this document reflect the current assessment on the date of publication. This information does not constitute a complete analysis of all material facts relating to any country,

region or market. This is not to be considered as financial analysis.

If statements are made about market developments, returns, price gains or other asset

growth as well as risk ratios, these merely constitute forecasts for whose occurrence we assume

no liability. Past performance, simulations or forecasts in particular are not a reliable

indicator of future performance. Assets can go up as well as down. All information has been carefully compiled; partly with recourse to information from third parties.Individual details may prove to be no longer or no longer fully accurate, in particular as a result of the passage of time, changes in the law, current developments on the markets, possibly at short notice, and may change at any time without prior notice. Therefore, no guarantee is given that all the information is correct, complete and up to date.

Please inform yourself independently about all costs relevant to you. Maintaining a custody

account may incur costs; ongoing bank charges may also be incurred. Transaction costs depend

on the asset class: For government bonds and collateralised bonds such as mortgage

bonds, they average around 0.02 percent, for corporate bonds 0.085 percent. For less liquid

bonds, the transaction costs can also be significantly higher than 0.25 per cent. It should also

be noted that transaction costs can temporarily be significantly higher during periods of market

stress. For all products sold by HAGIM, all relevant cost information is made available

prior to purchase.

The information is based on our assessment of the current legal and tax situation. If tax or

legal matters are affected, these should be discussed by the addressee with their tax advisor

or lawyer. Investments in financial instruments are associated with both opportunities and

risks. The handling of conflicts of interest at HAGIM is published online in the legal notice on

https://www.ha-gim.com/en/legal-information. The information contained in this document

is intended for professional clients and eligible counterparties only. This information document

is not directed at US citizens or permanent residents, nor to legal entities domiciled in

the USA, nor may it be distributed in the US.