Thomas Rentsch

Senior Portfolio Manager High Yield

Despite the threat of a trade war, zero growth in Germany and political uncertainty in Europe, the market for high yield corporate bonds is showing remarkable resilience. Risk premiums have been on a downward trend since mid-2022 and spreads for euro high yield bonds have reached their lowest level since mid-2017. But what does this mean for investors?

Downward trend in risk premiums

The risk premiums for high yield corporate bonds have fallen continuously since mid-2022. This is mainly due to stabilized inflation and the expected interest rate cuts by the European Central Bank (ECB). Investors still want to lock in yields before interest rates fall further, which is leading to continuous inflows into this asset class. In addition, the fundamentals of companies in the high yield category remain robust.

Spreads at their lowest level since 2017

At 212 basis points, risk premiums for euro high yield bonds without CCC are currently at their lowest level since November 2017¹. This is both a confirmation of market stability and an indication of investor confidence in the ability of companies to master the challenges of the current economic environment.

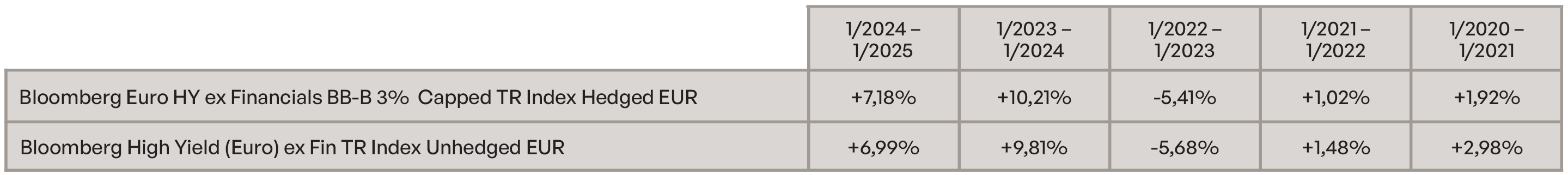

Source: Bloomberg (Bloomberg Euro HY ex Financials BB-B 3% Capped TR Index Hedged EUR, H23969EU Index; Bloomberg High Yield (Euro) ex Fin TR Index Unhedged EUR, I20672EU Index), as at 17.02.2025

Good news for investors

For investors who are already invested in high-yield corporate bonds, this is excellent news. They have enjoyed double-digit annualized returns since October 2022.

However, there is still a ray of hope for those who have missed out on this movement. The cost yield is still almost 4.4%, which is still well above the average of the last 20 years.²

Selective investment decisions required

In the current market situation, however, beta or benchmark investing is no longer in demand, but selective strategies are gaining in importance. Investors should now look for investment opportunities across the entire credit spectrum – across ratings, regions and currencies. This selective approach makes it possible to identify the best opportunities with controlled risk even in this environment.

HAGIM CIO-Series

Based on this investment philosophy, we have developed the Credit Income Opportunities product (CIO), which specifically addresses the needs of institutional fixed income investors. With our HAGIM CIO series, we bundle the best of all sub-segments in tailor-made portfolios. Our focus is on fundamental credit analysis and security selection in order to identify the best issuers and issues for our clients.

It enables differentiated selection and targeted risk management to maximize returns while minimizing potential risks in an uncertain market environment. With our investment philosophy based on intensive fundamental credit analysis, we at HAGIM believe that we are ideally equipped to meet the challenges of the current market environment and the individual investment requirements of institutional clients and are ready to support you in constructing investment solutions that meet your needs.

Source: Bloomberg (Bloomberg Euro HY ex Financials BB-B 3% Capped TR Index Hedged EUR, H23969EU Index; Bloomberg High Yield (Euro) ex Fin TR Index Unhedged EUR, I20672EU Index)

Risiken

Price losses due to increases in yields and/or higher risk premiums are possible. A total loss cannot be ruled out.

Past performance is not an indication of future results, nor can future performance be guaranteed.

Disclaimer

This marketing communication within the meaning of the German Securities Trading Act

(Wertpapierhandelsgesetz) is provided for information purposes only and should not be construed

as personal investment advice or a recommendation or solicitation to buy, sell or hold

any financial instrument or to adopt any investment strategy. The opinions and statements

contained in this document reflect the current assessment on the date of publication. This information does not constitute a complete analysis of all material facts relating to any country,

region or market. This is not to be considered as financial analysis.

If statements are made about market developments, returns, price gains or other asset

growth as well as risk ratios, these merely constitute forecasts for whose occurrence we assume

no liability. Past performance, simulations or forecasts in particular are not a reliable

indicator of future performance. Assets can go up as well as down. All information has been

carefully compiled; partly with recourse to information from third parties.

Individual details may prove to be no longer or no longer fully accurate, in particular as a

result of the passage of time, changes in the law, current developments on the markets, possibly

at short notice, and may change at any time without prior notice. Therefore, no guarantee

is given that all the information is correct, complete and up to date. Please inform yourself independently about all costs relevant to you. Maintaining a custody account may incur costs; ongoing bank charges may also be incurred. Transaction costs depend on the asset class: For government bonds and collateralised bonds such as mortgage bonds, they average around 0.02 percent, for corporate bonds 0.085 percent. For less liquid bonds, the transaction costs can also be significantly higher than 0.25 per cent. It should also be noted that transaction costs can temporarily be significantly higher during periods of market stress. For all products sold by HAGIM, all relevant cost information is made available

prior to purchase. The information is based on our assessment of the current legal and tax situation. If tax or legal matters are affected, these should be discussed by the addressee with their tax advisor

or lawyer. Investments in financial instruments are associated with both opportunities and

risks. The handling of conflicts of interest at HAGIM is published online in the legal notice on https://ha-gim.com/en/legal-information/. The information contained in this document is intended for professional clients and eligible counterparties only. This information document is not directed at US citizens or permanent residents, nor to legal entities domiciled in the USA, nor may it be distributed in the US.